illinois estate tax return due date

You can also avoid the penalty if your 2022 withholding or estimated tax payments equal at least 90 of your 2022 tax liability or 100 of. If any amount of Illinois transfer tax imposed by this Act is not paid on or before the initial due date for the Illinois transfer tax return without extensions interest shall be charged and collected on the unpaid amount at the rate of 10 per.

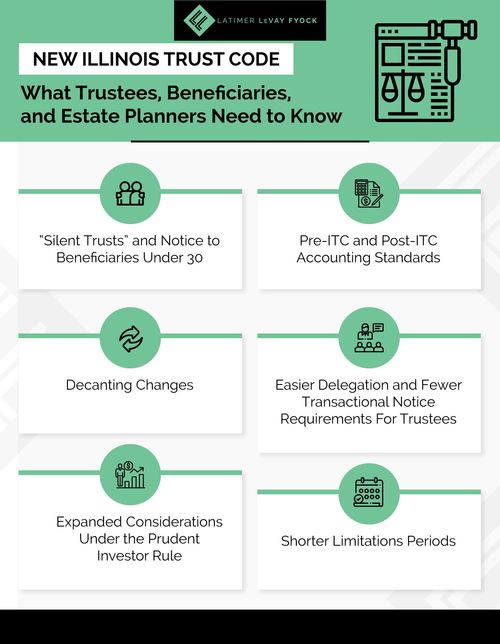

The New Illinois Trust Code What Trustees Beneficiaries And Estate Planners Need To Know Latimer Levay Fyock Website Website Of Llf Legal Based Out Of Chicago

For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

. Tax returns for S-corporations generally have a. Tax returns for partnerships and trusts generally have a due date of the 15 th day of the 4 th month following the end of their tax year. Real Estate Transfer Tax Declaration Form.

Its first tax lien fund was liquidated in 2011 and provided investors with a 141 annualized rate of return according to the company. Illinois estate tax means the tax due to this State with respect to a taxable transfer. Capital Gains and Losses - Transaction Adjustment Codes.

Real Estate Taxes. The due date for Tax Year 2020 First Installment was Tuesday March 2 2021. Show All Help Topics.

All of our 1000 Illinois real estate practice exam questions are similar to the ones you will find on the actual Illinois real estate exam and are written by a Licensed Real Estate Instructor. Terms and conditions may vary and are subject to change without notice. Under Illinois divorce laws a custodial parent may receive child support from the other parent.

In 2022 the estate tax exemption is 1206 million dollars. Illinois law defines a child as anyone under the age of 18 or anyone under the age of 19 who is still attending high school. Current tax bill amounts and due dates.

The department is providing a printable image of the required sign. County finances and Illinois Estate tax filings. To file this return you will need to get a tax identification number for the estate called an employer identification number or EIN.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. I. Value Notices Issued Nov.

When the return was filed. Independently Verified Business CPAs Provide Reliable Business Tax Info Online. The Senior Citizen Real Estate Tax Deferral Program.

Second an estate administrator may need to file income tax returns for the estate Form 1041. Between the date of death and the date the beneficiary takes over ownership of the account is also reported on the estates income tax return. Upgrade to two years for 90.

Corporate income tax due dates are generally the 15 th day of the 3 rd or 4 th month depending on the tax year end date of the corporation filing the return. Illinois supports a Flat Percentage of Income Model when determining payment amounts. Compare Online Tax Products.

The tax applies to all decedents who died after December 31 2001 but before January 1 2018. Interest and cost owing after due date until tax sale. Jul 01 Tax Bills Due 1st half installment preliminary bill.

A handful of states collect estate taxes. Tax Bills Due. This form shall be filled out completely signed by at least one of the grantors sellers or hisher agent and presented to the office of the director of financecity treasurer by email at email protected or in person at 44 East Downer Place Aurora Illinois 60507-2067 or by a designated agent at the time of obtaining of real estate transfer.

B The Department may refuse to issue or renew or may suspend the license of any person who fails to file a return pay the tax penalty or interest shown in a filed return or pay any final assessment of tax penalty or interest as required by any tax Act administered by the Department of Revenue until such time as the requirements of that. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. Grocery Tax Suspension Required StatementSign - Effective July 1.

The gift tax return is due on April 15th following the year in which the gift is made. Talk to Certified Business Tax Experts Online. Required payment date Date Return Submitted.

For other forms in the Form 706 series and for Forms 8892 and 8855 see the related instructions for due date information. Late payment penalties will occur after the Tax Day Deadline of April 18 2022 for Tax Year 2021 for unpaid taxes. Ad 247 Access to Reliable Income Tax Info.

The tax applies to property that is transferred by will or if the person has no will according to state laws of intestacyOther transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. After that any earnings related to the account become taxable to the. 10 penalty for late filing.

Checked penalties will be calculated. The only way to avoid late filing penalties is to e-File or file a Tax Return or Extension by Tax Day - April 18 2022 for Tax Year 2021 - and in case of a Tax Extension e-File the Tax Return by October 15 October 17 2022. Estates valued under that threshold do not pay estate tax and no IRS filing is required.

IRS Letter 12C - Reconciliation of Premium Tax Credit Payments. Compare Desktop Tax Products. The New Jersey Estate Tax is a lien on all property of a decedent as of their date of death.

Since late filing penalties are. Use the return envelopes supplied with your tax bills or mail to. Filing a Federal Individual Tax Return Extension - Form 4868.

An estate is required to file an income tax return if assets of the estate generate more than 600 in annual income. The value of the decedents property will be calculated either at fair market value on the date of the decedents death the fair market value 6 months after the death of the decedent or a special use valuation may be utilized in certain circumstances if federal estate tax laws apply to the decedents estate. Trial calculations for tax owed per return over 750 and under 20000.

Form 1099-S - Sale of Real Estate Property. Every taxpayer has a lifetime estate tax exemption. The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies.

Our Illinois real estate practice exams are up to date with the latest 2022 rules and regulations and are guaranteed to help prepare you to pass the. The law requires written consent ie a tax waiver from the Director before transferring property owned by a decedent as of their date of death to a. Tax amounts paid in prior years.

Any income earned by the POD account prior to the date the bequeather died is reported on their final income tax return. Motor Fuel Retailer Sign - Effective July 1 2022 through December 31 2022 Public Act 102-0700 requires a notice to be posted in a prominently visible place on each retail dispensing device that is used to dispense motor fuel in the State of Illinois. Assessment Date Mar 1.

Assessment Date Real Estate only. A federal estate tax is paid on the value of the taxable estate that exceeds that threshold amount. When choosing an investment company that offers tax-lien funds be sure to use the Financial Industry Regulatory Authoritys FINRA BrokerCheck to investigate the firms background and any disclosures.

Cook County Treasurer PO Box 805436 Chicago IL 60680-4155 Your canceled check is your receipt.

Illinois Probate What Are Letters Of Office Law Offices Of Jeffrey R Gottlieb Llc

State Corporate Income Tax Rates And Brackets Tax Foundation

How Have The Ancestrydna Ethnicity Esitmates Changed And What Do The New Numbers Mean Ancestry Ethnicity Ge Ancestry Dna Ancestry Family Tree Dna Genealogy

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Illinois Probate What Are Letters Of Office Law Offices Of Jeffrey R Gottlieb Llc

Fiduciary Trust And Estate Income And Replacement Taxes

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Prepare And E File Your 2021 2022 Illinois And Irs Income Tax Return

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Illinois Quit Claim Deed Form Quites Illinois The Deed

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate And Trust Tax Id Numbers Faq On The Ein From The Irs Law Offices Of Jeffrey R Gottlieb Llc

Calculating The Illinois Estate Tax

The 5 Steps Of The Illinois Probate Process

How Long Does Probate Take In Illinois Estate And Probate Legal Group